-

Authoradmin

-

Comments0 Comments

-

Category

-

Tag

Trading is still stable at 111.70 (the second objective of the bullish scenario) and around the upper limit of the bullish channel shown on the 4 hour chart … Stochastic is pointing to a positive cross and the RSI is still within the bullish momentum area. The 50 is probably indicating that the price has […]

-

Authoradmin

-

Comments0 Comments

-

Category

-

Tag

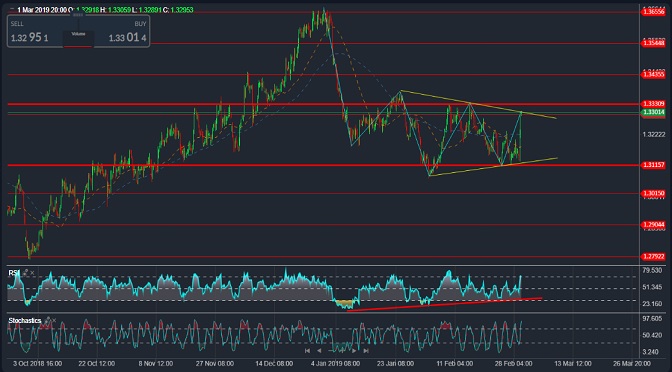

The negative pressure on the pair continues to move below the bullish trend line shown on the 4 hour chart and below the SMA 50 ending the bullish scenario that achieved its first target at 1.3340 … although the breach of this trend signals further downside but the trend structure is still bullish Supported by […]

-

Authoradmin

-

Comments0 Comments

-

Category

-

Tag

The Euro fell yesterday, breaching the bullish trend formation started by mid last month and ending below the support of 1.1350 ending the bullish scenario which achieved its first target at 1.1405 … stability below 1.1350 – 1.1365, in addition to the negative cross of the 50 and 100 simple moving averages on the hour […]

-

Authoradmin

-

Comments0 Comments

-

Category

-

Tag

The pair is still moving sideways between the resistance at 0.7190 and the support at 0.7075 … it is preferable to remain neutral until one of these levels is breached to confirm its direction. A breach of 0.7190 – 0.7200 could push the pair to target resistance at 0.7290 as the first target, then resistance […]

-

Authoradmin

-

Comments0 Comments

-

Category

-

Tag

The pair rallied strongly on Friday breaking the resistance at 1.3235, ending the possibility of a decline … trading is limited within a symmetrical triangle pattern and we see the four-hour timeframe … it is better to stay neutral until the signals determine the direction of the price. Breakout Resistance 1.3330 The upside-down head and […]

-

Authoradmin

-

Comments0 Comments

-

Category

-

Tag

The pair is fluctuating around the resistance area 0.9980 – 1.0005, which is supported by the SMA 50 on the 4 hour frame … and the downside remains valid as long as the trades are below the 100 level … The pair could resume its downside move towards 0.9910 as the first target and then […]

-

Authoradmin

-

Comments0 Comments

-

Category

-

Tag

A clear breach of 23.6% Fibonacci as seen on the daily chart, pushing it to further decline to test 38.2% around 1275 as the first target, which breached it may press the price to turn to the next support around 1250 – 1240 … The price may need to retest 1300 – 1302 to gather […]

-

Authoradmin

-

Comments0 Comments

-

Category

-

Tag

The pair is trading at a high of 111.70 (the second objective of the bullish scenario) and around the upper limit of the ascending channel shown on the 4 hour chart … The current uptrend could continue to the third target at 112.50, but the saturation of Stochastic and RSI The price may force the […]

-

Authoradmin

-

Comments0 Comments

-

Category

-

Tag

The pair fell from last Friday’s trading below 1.3210 support to receive support from the bullish trend line shown on the 4 hour chart … The possible bullish scenario remains intact as long as the trades remain above the mentioned trend line and the pair may return to face resistance 1.3340 (the first target on […]

-

Authoradmin

-

Comments0 Comments

-

Category

-

Tag

Trading remains limited between the resistance 1.1405 (the first target of the ascending scenario) and the support 1.1350 … to keep the possible bullish scenario as long as the trading support is higher 1.1325 and the pair could return again to counter the resistance 1.1405, which may push the price to the second target at […]

Recent Comments

- Starlight Herot on Euro Higher on German Data, Sterling Edges Lower

- Frost Dragont on Euro Higher on German Data, Sterling Edges Lower

- Gwinnettt on Euro Higher on German Data, Sterling Edges Lower

- Vanessat on Euro Higher on German Data, Sterling Edges Lower

- Christinet on Euro Higher on German Data, Sterling Edges Lower

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- February 2024

- July 2023

- July 2021

- May 2021

- March 2021

- February 2021

- September 2020

- May 2020

- February 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017