-

Authoradmin

-

Comments0 Comments

-

Category

-

Tag

focal: 1.3350The pair is still within the ascending channel and is heading towards achieving the first target at 1.3414 and with a break of 1.3430 could push the pair to further gains at the second target 1.3450A return below 1.3350 might see the negativity close to the 1.3330 level and breaching this level will push […]

-

Authoradmin

-

Comments0 Comments

-

Category

-

Tag

focal:1310.00Upward scenarioThe stability of the precious metal above the base level may push it to 1320.50 and with a breach of this level we might test the 1325.00 level. We may see strong resistance at this pointDownward scenarioWith a breach of the base level at 1310.00 may push the pair to test the resistance of […]

-

Authoradmin

-

Comments0 Comments

-

Category

-

Tag

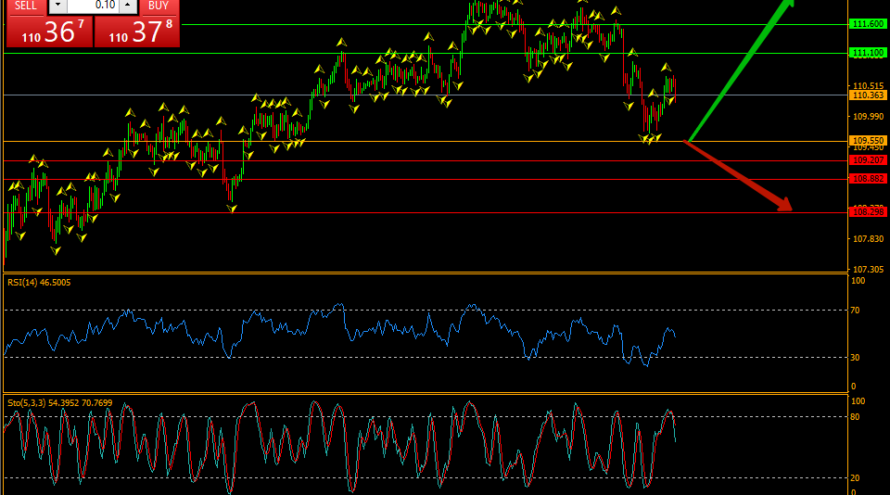

focal: 109.55Upward scenarioThe pair is heading towards achieving the first target at 111.10 and with the stability and break this level may see further gains at 111.60 and with the breach of this point pushing the pair to achieve the third target at 112.15Downward scenarioTo return to the bearish scenario, the pair must break the […]

-

Authoradmin

-

Comments0 Comments

-

Category

-

Tag

Yesterday, the pair received support from the SMA 100 on the four hour frame to close at a high near the resistance level of 0.7145. A breach of this resistance might reinforce the possibility of a bullish move. The pair could then target 0.7215 as the first target and resistance 0.7290 as the second target. […]

-

Authoradmin

-

Comments0 Comments

-

Category

-

Tag

The bullishness remains valid as long as the pair is above the bullish trend line shown on the 4 hour chart, but it is better to break the resistance 1.3340 (the first objective of the ascending scenario) to confirm this possibility, Resistance 1.3480 then 61.8% for the general downside wave around 1.3630 as a third […]

-

Authoradmin

-

Comments0 Comments

-

Category

-

Tag

The pair fell during Thursday and Friday to settle below the upper limit of the bearish wedge pattern shown on the 4 hour chart. A breach of support at 0.7055 might be enough to end the upside potential, and the pair could then go to test 61.8% Fibonacci at 0.6960. The rise and break of […]

-

Authoradmin

-

Comments0 Comments

-

Category

-

Tag

The pair ended the trading session last Friday on the upside after receiving support from the bullish trend line shown on the 4 hour chart, breaking the resistance 1.3340 (the first objective of the bullish scenario that has been achieved) may push the price to further rise towards the second target level at 1.3480 resistance […]

-

Authoradmin

-

Comments0 Comments

-

Category

-

Tag

Following the neckline of the upside-down head and shoulders pattern shown on the chart, the pair rose yesterday to settle above the 50 and 100 SMA, which supports the possibility of further gains towards 1.3435 (the former target), 1.3545 as the second target and resistance at 1.3655. As a third target. A break of the […]

-

Authoradmin

-

Comments0 Comments

-

Category

-

Tag

The possible bullish scenario remains intact as long as the pair remains above the 1298 support to be the next targets around the resistance 1326 as the first target and then the February summit around 1345 as the second target. A break of the recent 4-hour closing below 1298 might be enough to derail the […]

-

Authoradmin

-

Comments0 Comments

-

Category

-

Tag

The possible bearish scenario remains intact as long as the trading remains below resistance 111.70 and the pair may be testing the support at 110.05 as the first target and then the 109.25 support as the second target and it could extend to support 108.50 as the third target. A breach of 111.70 resistance might […]

Recent Comments

- Starlight Herot on Euro Higher on German Data, Sterling Edges Lower

- Frost Dragont on Euro Higher on German Data, Sterling Edges Lower

- Gwinnettt on Euro Higher on German Data, Sterling Edges Lower

- Vanessat on Euro Higher on German Data, Sterling Edges Lower

- Christinet on Euro Higher on German Data, Sterling Edges Lower

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- February 2024

- July 2023

- July 2021

- May 2021

- March 2021

- February 2021

- September 2020

- May 2020

- February 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017