-

Authoradmin

-

Comments0 Comments

-

Category

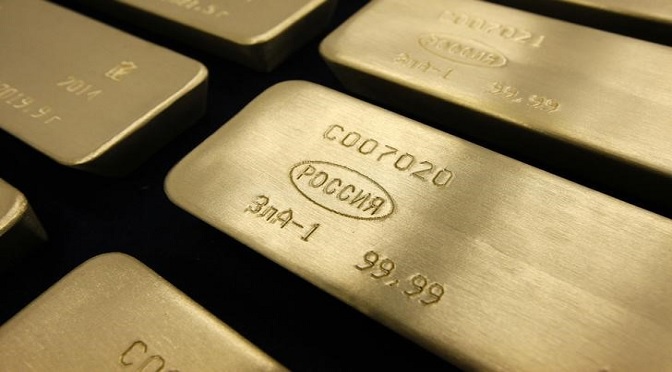

Gold prices fell to one-and-a-half week lows on Thursday, after the minutes of the Federal Reserve’s latest policy minutes pointed to the need for further interest rate hikes, sending the U.S. dollar higher.

Comex gold futures were down 0.62% at $1,323.7 a troy ounce by 02:00 a.m. ET (06:00 GMT), the lowest since February 14.

The minutes of the Fed’s January policy meeting released on Wednesday showed that central bank officials see increased economic growth and rising inflation as justification to continue to raise interest rates gradually.

The news lent broad support to the greenback despite sustained worries over the U.S. deficit, which is projected to climb near $1 trillion in 2019 following the recent announcement of infrastructure spending and large corporate tax cuts.

Gold is sensitive to moves in both U.S. rates and the dollar. A stronger dollar makes gold more expensive for holders of foreign currency, while a rise in U.S. rates lifts the opportunity cost of holding non-yielding assets such as bullion.

The U.S. dollar index, which measures the greenback’s strength against a trade-weighted basket of six major currencies, was up 0.13% at 90.14, the highest since February 12.

The dollar had been pressured lower recently by expectations for a faster pace of monetary tightening outside the U.S., which would lessen the divergence between the Fed and other central banks.

Elsewhere on the Comex, silver futures lost 1.34% to $16.39 a troy ounce.

Recent Comments

- Starlight Herot on Euro Higher on German Data, Sterling Edges Lower

- Frost Dragont on Euro Higher on German Data, Sterling Edges Lower

- Gwinnettt on Euro Higher on German Data, Sterling Edges Lower

- Vanessat on Euro Higher on German Data, Sterling Edges Lower

- Christinet on Euro Higher on German Data, Sterling Edges Lower

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- February 2024

- July 2023

- July 2021

- May 2021

- March 2021

- February 2021

- September 2020

- May 2020

- February 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017