-

Authoradmin

-

Comments0 Comments

-

Category

-

Tag

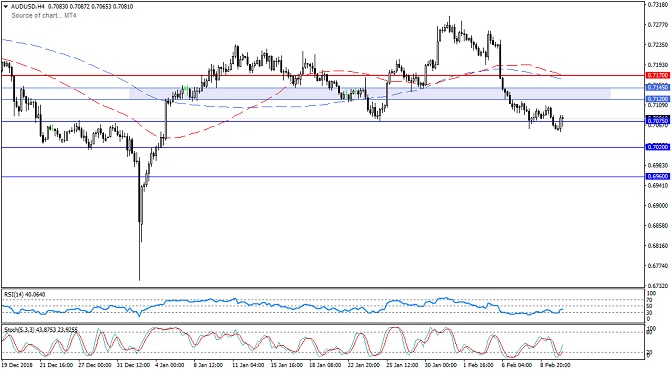

The pair is hovering around the first target of the bearish scenario at 0.7075 since the opening of this week’s trading … The possible bearish scenario remains intact as long as the pair remains below 0.7170 and could target its second target around 0.7020 support and then the 61.8% Fibonacci retracement of the recent bullish […]

-

Authoradmin

-

Comments0 Comments

-

Category

-

Tag

Stability above 1.3230 – 1.3210 supports the potential bullish scenario with targets around 1.3370 as the first target, then 1.3515 as the second target and then the last summit around 1.3660 as the third target. A break and support break of 1.3175 with four-hour closing might be enough to derail the upside scenario and could […]

-

Authoradmin

-

Comments0 Comments

-

Category

-

Tag

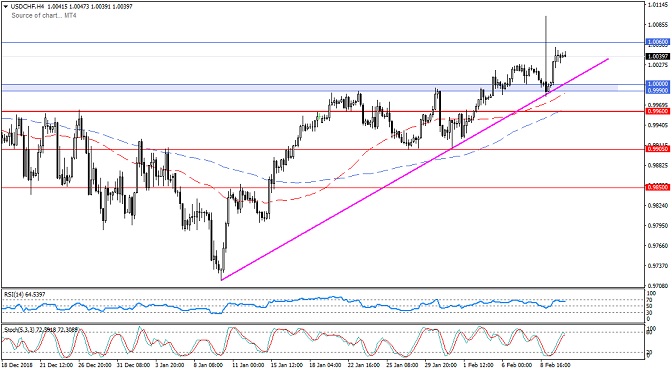

Yesterday, the pair rose again from its first target at 1.0060 after receiving support from the 1.0000 – 0.9990 area which corresponds to the ascending trend line shown on the chart. The possible bullish scenario remains intact as long as the trades remain above the mentioned trend line to remain the next key target around […]

-

Authoradmin

-

Comments0 Comments

-

Category

-

Tag

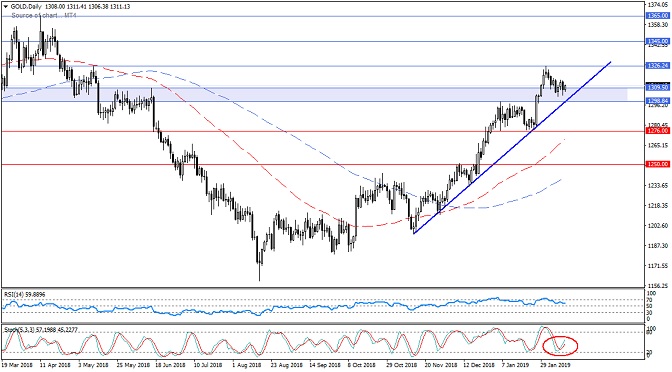

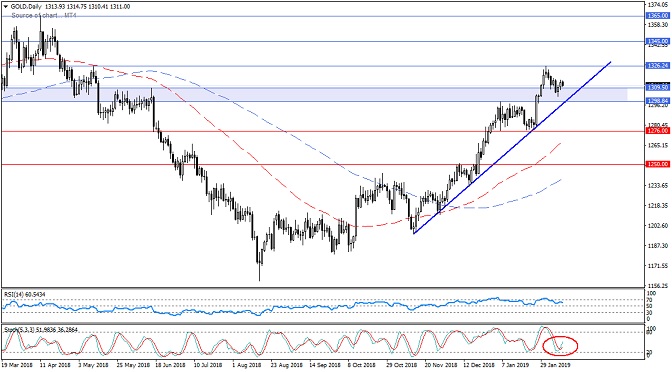

Gold keep moving near the 1309-1298 support area … RSI is still within the bullish momentum and Stochastic points to a positive … The upside potential remains valid as long as the trades remain above the ascending trend line shown on the daily chart to keep the targets around 1326 resistance as the first target, […]

-

Authoradmin

-

Comments0 Comments

-

Category

-

Tag

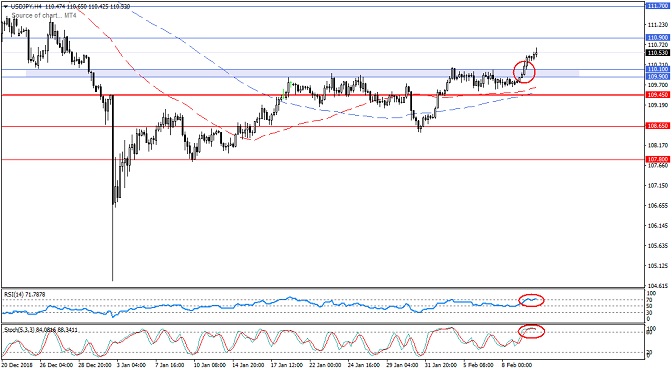

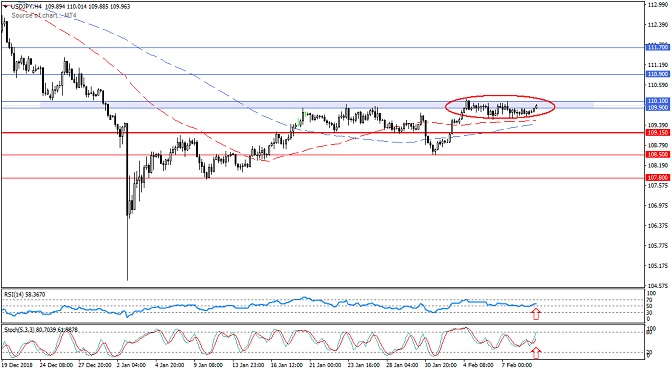

A clear breach of the resistance area 109.90 – 110.10 and we see on the four hour chart confirms the possibility of resuming the bullish trend whose targets are around 110.90 as the first target and then 111.70 as a second target … The saturation that appears on the Stochastic and RSI may press the […]

-

Authoradmin

-

Comments0 Comments

-

Category

-

Tag

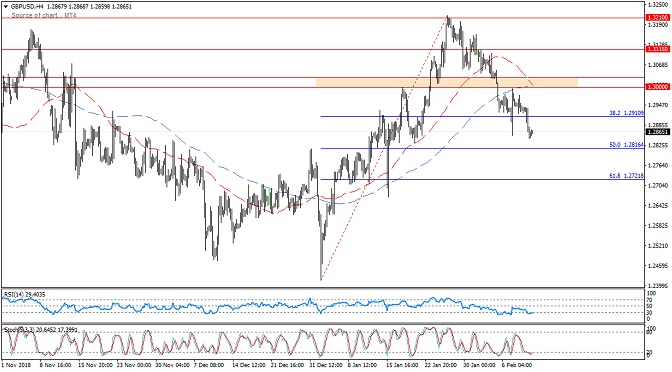

The pair ended yesterday’s trading below the first target of the downside scenario at 1.2910 (38.2% Fibonacci) … The price is approaching its second target at 1.2810-15 (50% Fibonacci) … The possible bearish scenario remains dropping as long as trades remain below 1.3000 – 1.3030 … A breach of 1.2810 could extend from the current […]

-

Authoradmin

-

Comments0 Comments

-

Category

-

Tag

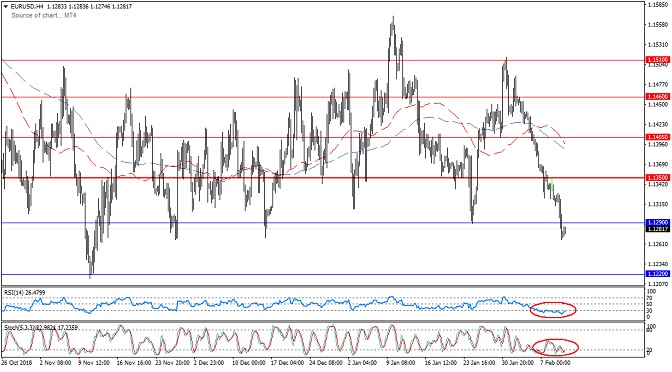

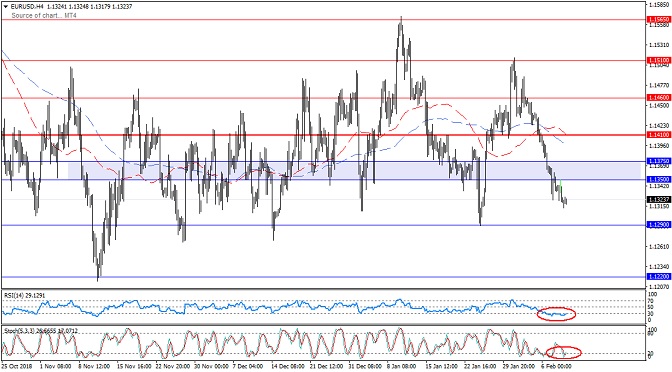

The negative pressure continues on the pair to stabilize the pairing at the moment below the second target level of the downside scenario at 1.1290. The bearishness indicators are appearing on the Stochastic and RSI indicators …..possible downside scenario remains with weak area being revised around the first target levels at 1.1350 and could target […]

-

Authoradmin

-

Comments0 Comments

-

Category

-

Tag

continue moving near the 1309-1298 support area … RSI is still within the bullish momentum and Stochastic points to a positive cross The upside potential remains valid as long as the trades remain above the ascending trend line shown on the daily chart to keep the targets around 1326 resistance as the first target, which […]

-

Authoradmin

-

Comments0 Comments

-

Category

-

Tag

The pair is still moving within the narrow range around the resistance area 109.90 – 110.10 … It is better to wait until this resistance is breached and confirm the upside move to be the next potential targets around 110.90 as the first target and 111.70 as the second target. but the drop and the […]

-

Authoradmin

-

Comments0 Comments

-

Category

-

Tag

The potential bearish scenario remains valid with steady trading below 1.1410 … The pair may be heading towards its second target around 1.1290 support and then the main target around 1.1220 (the low of November 2018) … The saturation of the Stochastic and RSI indicators on the four hour frame may push Pair to test […]

Recent Comments

- Starlight Herot on Euro Higher on German Data, Sterling Edges Lower

- Frost Dragont on Euro Higher on German Data, Sterling Edges Lower

- Gwinnettt on Euro Higher on German Data, Sterling Edges Lower

- Vanessat on Euro Higher on German Data, Sterling Edges Lower

- Christinet on Euro Higher on German Data, Sterling Edges Lower

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- February 2024

- July 2023

- July 2021

- May 2021

- March 2021

- February 2021

- September 2020

- May 2020

- February 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017