-

Authoradmin

-

Comments0 Comments

-

Category

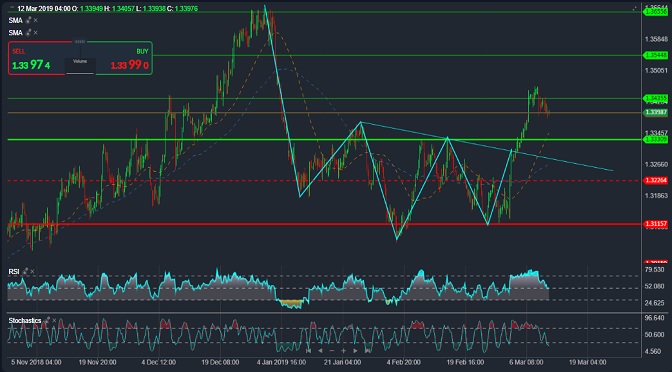

The pair is moving sideways below 1.3340 (the first target that was achieved) in an attempt to gain bullish momentum due to the saturation signals indicated by the Stochastic and rsi indicators on the daily time frame … breaching the mentioned resistance may push the price to further rise towards the second resistance level 1.3480 […]

-

Authoradmin

-

Comments0 Comments

-

Category

The potential bullish scenario remains intact as long as the pair remains above 1.1230 to be the potential targets around the bearish trend line shown on the chart at 1.1400 as the first target, which could push the pair further towards resistance 1.1500 as a second target … A return to the downside and a […]

-

Authoradmin

-

Comments0 Comments

-

Category

The pair has risen since the opening of trading this week to enter within the resistance zone 0.7055 – 0.7075 during the Asian session today … This may be an attempt to gain enough bearish momentum. The possible bearish scenario remains intact as long as the trades remain below the 4 hour chart’s bearish line, […]

-

Authoradmin

-

Comments0 Comments

-

Category

-

Tag

Stochastic is moving within the oversold area and the RSI is trying to base itself on the midline 50, so that the possible bullish scenario remains valid with the upside of the upsidedown head and shoulders pattern shown on the chart to be the next targets around 1.3545 as the second target and then the […]

-

Authoradmin

-

Comments0 Comments

-

Category

-

Tag

The potential bullish scenario which has reached its first target at 1.0095 remains intact as long as the pair remains above 1.0030, and the pair can move to the second target around 1.0165 and 1.0250 as the third target. A drop and a break of 1.0030 might be enough to end the upside scenario, and […]

-

Authoradmin

-

Comments0 Comments

-

Category

-

Tag

The possible bearish scenario remains intact as long as the trading remains below 1305 (23.6% Fibonacci) to be the first target at 38.2% Fibonacci around 1275 and the breach may press the gold to the next support around 1250-1240. A breach of 1305 and stability above might be enough to end the current correction and […]

-

Authoradmin

-

Comments0 Comments

-

Category

-

Tag

The pair continues to rise after receiving support from the level of 110.90, despite this rise, but trading is still stuck between the moving averages of 50 and 100 … The return of the price of trading higher than the simple moving average 50 around 111.70 may enhance the possibility of the rise to the […]

-

Authoradmin

-

Comments0 Comments

-

Category

The pair received support from the 4-hour chart’s bullish trend line, which rose strongly during yesterday’s trading, breaking the corrective correction structure and ending the downside scenario that achieved its first target at 1.3000 … The pair is currently trying to consolidate the 1.3140-1.300 area and gather enough momentum Rising before heading to the last […]

-

Authoradmin

-

Comments0 Comments

-

Category

-

Tag

The EUR is trading higher after finding support from the 1.1185 level of 61.8% Fibonacci of the wave which started from the bottom of 01/01/2017 and ended at the top of 10/02/2018 … A daily close below the mentioned level could push the EUR further bearish towards 1.1100 As the first target and then psychological […]

-

Authoradmin

-

Comments0 Comments

-

Category

-

Tag

Trading remains stable below 0.7055 – 0.7075 support area, which was breached during last Wednesday’s trading … The possible bearish scenario remains intact as long as the pair remains below the bearish trend line shown on the 4 hour chart. The targets remain around 61.8% Fibonacci at 0.6960 as the first target, May extend from […]

Recent Comments

- Starlight Herot on Euro Higher on German Data, Sterling Edges Lower

- Frost Dragont on Euro Higher on German Data, Sterling Edges Lower

- Gwinnettt on Euro Higher on German Data, Sterling Edges Lower

- Vanessat on Euro Higher on German Data, Sterling Edges Lower

- Christinet on Euro Higher on German Data, Sterling Edges Lower

Archives

- November 2024

- October 2024

- February 2024

- July 2023

- July 2021

- May 2021

- March 2021

- February 2021

- September 2020

- May 2020

- February 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017