-

Authoradmin

-

Comments0 Comments

-

Category

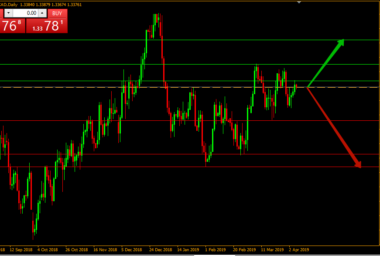

The pair received support from 1.2830 – 1.2815 (50% Fibonacci), rising during the US session yesterday and morning intraday trading near the upper limit of the bearish channel shown on the 4 hour chart … Stochastic is floating within the oversold area and the RSI is still within the momentum zone Down below the 50 line.

The potential bearish scenario remains intact as long as the pair remains below 1.3000 and the pair may resume its decline to 1.2830-1.22815 (the second target of the downside scenario), which could push the price directly to 61.8% at 1.2700 – 1.2720 as the third target.

A breach of the bearish trend formation, which is confirmed by a four-hour closing above 1.3000, might be enough to end the downside scenario. The price could then push towards 1.3105 as the first target and then 1.3210 as the second target.

Recent Comments

- Starlight Herot on Euro Higher on German Data, Sterling Edges Lower

- Frost Dragont on Euro Higher on German Data, Sterling Edges Lower

- Gwinnettt on Euro Higher on German Data, Sterling Edges Lower

- Vanessat on Euro Higher on German Data, Sterling Edges Lower

- Christinet on Euro Higher on German Data, Sterling Edges Lower

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- February 2024

- July 2023

- July 2021

- May 2021

- March 2021

- February 2021

- September 2020

- May 2020

- February 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017