-

Authoradmin

-

Comments0 Comments

-

Category

-

Tag

Although the negativity was evident on the pair, especially after it remained below the SMA 100 on the four hour frame, it is better to wait for four hours closing below 0.9980 to confirm the continuation of the downside towards support 0.9910 as the first target and 0.9840 as the second target. A return to […]

-

Authoradmin

-

Comments0 Comments

-

Category

-

Tag

Gold ended higher on Friday after consolidating the support area 1325-1330 (31/01/2019) to keep the possible bullish scenario as long as the pair remains above the ascending trend line shown on the daily chart and may return to the 1345 level The second achieved on 20/02/2019), which breached it may push the price to the […]

-

Authoradmin

-

Comments0 Comments

-

Category

-

Tag

The pair is still trading weakly around its first target at 110.90 … The possible bullish scenario remains intact as long as trades remain above 109.75, and could target the second target at 111.70 and then the 112.50 as the third target … Momentum indicators on each of the four hour time frames, Probability. A […]

-

Authoradmin

-

Comments0 Comments

-

Category

-

Tag

The pair tested the support level at 1.2960 last Friday and quickly returned to trade near its first target at 1.3090 resistance … Stochastic indicates a saturation on both the four-hour and daily time frames, which may put pressure on the price again … but the possibility of a rise remains As long as the […]

-

Authoradmin

-

Comments0 Comments

-

Category

-

Tag

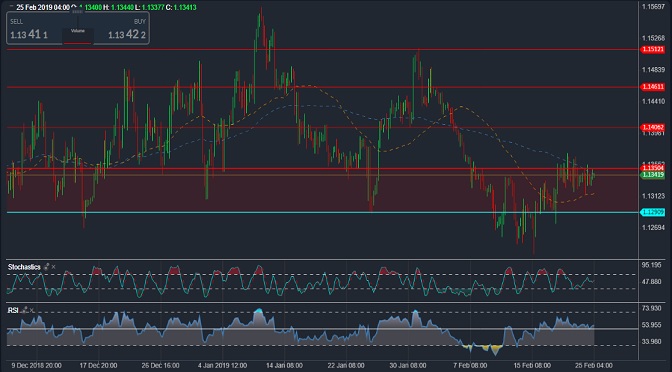

The pair is trading around the 1.1350 level … It is preferable to remain neutral until the breach above the mentioned level and stability above to confirm the possibility of rising towards resistance 1.1405 as the first target and then 1.1460 as the second target at least. A decline and a return to trade below […]

-

Authoradmin

-

Comments0 Comments

-

Category

-

Tag

The pair is rising during the morning session of the day back from the support level 0.7075 … It is better to remain neutral until the exit of the price from the area specified on the chart to confirm its direction … A breach of 0.7075 could push the price to target support at 0.7020 […]

-

Authoradmin

-

Comments0 Comments

-

Category

-

Tag

The downside scenario remains valid as long as the trades remain below the resistance 1.3325 … Stochastic is pointing to a negative cross within the oversold area which may be a sign that the price has gathered enough momentum to resume its support towards 1.3070 as the first target, Towards 1.2915 as a second target […]

-

Authoradmin

-

Comments0 Comments

-

Category

-

Tag

The pair’s movements are limited within the range between the SMA 100 and the 0.9980 support … it is preferable to remain neutral until the price is way out from the area specified on the chart to confirm its direction … Going back to the highest 1.0060 might be sufficient to confirm the possibility of […]

-

Authoradmin

-

Comments0 Comments

-

Category

-

Tag

Trading in gold has declined over the past two days because of the saturation of the stochastic and RSI indicators on the daily basis … The price is moving favorably during today’s trading after receiving support from 1325-1330 … The possible bullish scenario remains valid as long as the trades remain above the ascending trend […]

-

Authoradmin

-

Comments0 Comments

-

Category

-

Tag

The pair is still trading weakly around its first target at 110.90 … The possible bullish scenario remains intact as long as trades remain above 109.75, and could target the second target at 111.70 and then the 112.50 as the third target … Momentum indicators on each of the four hour time frames, Probability. A […]

Recent Comments

- Starlight Herot on Euro Higher on German Data, Sterling Edges Lower

- Frost Dragont on Euro Higher on German Data, Sterling Edges Lower

- Gwinnettt on Euro Higher on German Data, Sterling Edges Lower

- Vanessat on Euro Higher on German Data, Sterling Edges Lower

- Christinet on Euro Higher on German Data, Sterling Edges Lower

Archives

- January 2025

- December 2024

- November 2024

- October 2024

- February 2024

- July 2023

- July 2021

- May 2021

- March 2021

- February 2021

- September 2020

- May 2020

- February 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017