-

Authoradmin

-

Comments0 Comments

-

Category

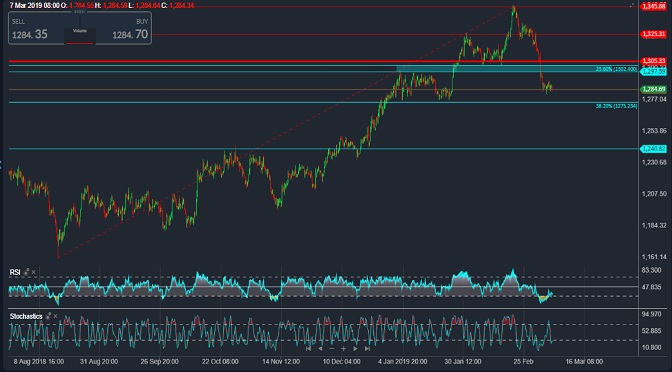

The pair has moved sideways over the past two days in an attempt to gain bearish momentum due to the oversold resistance shown on the RSI on the daily basis … The 1300-1302 rally seems to be possible but the possible bearish scenario remains intact as long as the trading remains below 1305 (23.6% Fibonacci) […]

-

Authoradmin

-

Comments0 Comments

-

Category

-

Tag

he pair has been floating sideways around 111.70 (the second objective of the bullish scenario) since the opening of this week’s trading … Stochastic on the daily time frame is trying to exit the oversold area and the four hours is moving within the oversold area and the RSI is still within the bullish momentum […]

-

Authoradmin

-

Comments0 Comments

-

Category

-

Tag

Trading is limited between the 1.3100 support and the resistance of SMA 50 … The price direction is between the downside and the resistance below 1.3245 and the upside after the rebound from the 1.3100 support … so it is preferable to remain neutral until the pair is out of the area specified on the […]

-

Authoradmin

-

Comments0 Comments

-

Category

-

Tag

The pair exceeded its first target at 1.1315 to return to test yesterday and to gather some bearish momentum … The possible downside scenario remains as long as the trading below the resistance 1.1365, and may be heading to the second target at 1.1275 support and then the bottom which is the middle of February […]

-

Authoradmin

-

Comments0 Comments

-

Category

-

Tag

The pair has been floating since the opening of trading this week around the lower border of the side trend area shown on the chart at 0.7075 – 70 … It is best to stay neutral until the pair is out of the mentioned area to confirm its direction. A break of support at 0.7075 […]

-

Authoradmin

-

Comments0 Comments

-

Category

-

Tag

The pair ended yesterday’s trading on the breach of the neckline pattern of the upside down head and shoulders pattern shown on the 4 hour chart, but it is better to wait for a breach of resistance 1.3325 to confirm the reversal of the mentioned pattern to be the next targets around 1.3435 as the […]

-

Authoradmin

-

Comments0 Comments

-

Category

-

Tag

The downside potential remains valid as long as trading remains below 1305 (23.6% Fibonacci level) … The price is heading to its first target at 38.2% around 1275 and the breach may press the gold to move to the next support around 1250-1240 The price may need to retest 1300-1302 to gather enough bearish momentum […]

-

Authoradmin

-

Comments0 Comments

-

Category

-

Tag

Trades continue to fluctuate within the resistance zone 0.9980 – 1.0005, which is supported by the 50 and 100 moving averages on the 4 hour frame which is trying to pressure the price. However, breaking the latest bearish trend and the positive cross of Stochastic near the oversold area may signal further upside … So […]

-

Authoradmin

-

Comments0 Comments

-

Category

-

Tag

Trading is still stable at 111.70 (the second objective of the bullish scenario) and around the upper limit of the bullish channel shown on the 4 hour chart … Stochastic is pointing to a positive cross and the RSI is still within the bullish momentum area. The 50 is probably indicating that the price has […]

-

Authoradmin

-

Comments0 Comments

-

Category

-

Tag

The negative pressure on the pair continues to move below the bullish trend line shown on the 4 hour chart and below the SMA 50 ending the bullish scenario that achieved its first target at 1.3340 … although the breach of this trend signals further downside but the trend structure is still bullish Supported by […]

Recent Comments

- Starlight Herot on Euro Higher on German Data, Sterling Edges Lower

- Frost Dragont on Euro Higher on German Data, Sterling Edges Lower

- Gwinnettt on Euro Higher on German Data, Sterling Edges Lower

- Vanessat on Euro Higher on German Data, Sterling Edges Lower

- Christinet on Euro Higher on German Data, Sterling Edges Lower

Archives

- January 2025

- December 2024

- November 2024

- October 2024

- February 2024

- July 2023

- July 2021

- May 2021

- March 2021

- February 2021

- September 2020

- May 2020

- February 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017