-

Authoradmin

-

Comments0 Comments

-

Category

-

Tag

The possible bearish scenario remains intact as long as the trades remain below the 4 hour chart’s bearish line, targets remain around the 61.8% Fibonacci level at 0.6960 as the first target and the breach may extend from the downside to the 0.6840 support as the second target. A break of the 4-hour downtrend above […]

-

Authoradmin

-

Comments0 Comments

-

Category

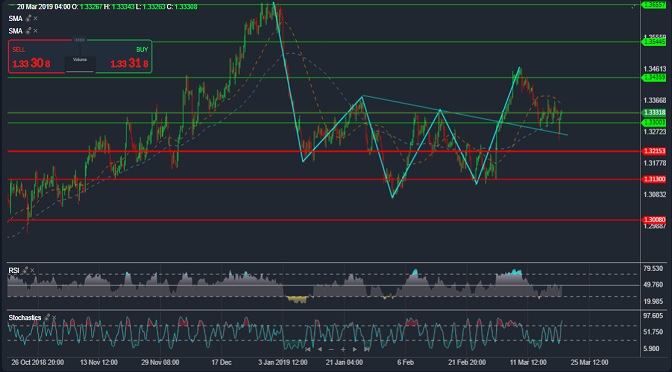

The pair is fluctuating around the neckline of the upside down head and shoulders pattern shown on the chart … and the possibility of a bullish move remains intact as long as the pair remains above 1.3215 and the pair could return to 1.3435 (first target) and 1.3545 as the second target and then 1.3655 […]

-

Authoradmin

-

Comments0 Comments

-

Category

The price is currently floating around the 4-hour uptrend line which is breached by a four-hour closing below 0.9975. It may be making a bearish scenario with targets around 0.9910 as the first target and then 0.9830 as the second target. A return to the upside and a breach of resistance 1.0095 could push the […]

-

Authoradmin

-

Comments0 Comments

-

Category

-

Tag

Trading is limited between resistance 1310 and support 1293 … exit price from this area may be enough to confirm its direction … A breach of 1310 could reinforce the upside potential towards 1326 resistance as the first target and then the 1345 resistance as the second target … What breach of support 1293 might […]

-

Authoradmin

-

Comments0 Comments

-

Category

-

Tag

The pair is moving in a sideways direction forming a symmetrical triangle pattern as shown on the four hour chart … Going out of the area specified in the image determines the direction of the price. A breach of 111.85 could push the pair to target 112.50 as the first target then 113.15 as the […]

-

Authoradmin

-

Comments0 Comments

-

Category

The pair is moving sideways below 1.3340 (the first target that was achieved) in an attempt to gain bullish momentum due to the saturation signals indicated by the Stochastic and rsi indicators on the daily time frame … breaching the mentioned resistance may push the price to further rise towards the second resistance level 1.3480 […]

-

Authoradmin

-

Comments0 Comments

-

Category

The potential bullish scenario remains intact as long as the pair remains above 1.1230 to be the potential targets around the bearish trend line shown on the chart at 1.1400 as the first target, which could push the pair further towards resistance 1.1500 as a second target … A return to the downside and a […]

-

Authoradmin

-

Comments0 Comments

-

Category

-

Tag

By Roslan Khasawneh, Ahmed Rasheed and Ahmed Elumami SINGAPORE/BAGHDAD/TRIPOLI (Reuters) – At least two tankers have ferried Iranian fuel oil to Asia in recent months despite U.S. sanctions against such shipments, according to a Reuters analysis of ship-tracking data and port information, as well as interviews with brokers and traders. The shipments were loaded onto […]

By Tom Finn LONDON (Reuters) – The dollar rose on Wednesday, attracting safe-haven bids after reports of further tension in U.S.-China trade negotiations, but its gains were slight, with caution expected from the Federal Reserve at its policy meeting later in the day. Volatility in foreign exchange markets has plummeted due to a dovish shift […]

By Tom Finn LONDON (Reuters) – The Japanese yen rose on Tuesday, benefiting from a U.S. dollar hit by concern over the U.S. economy and expectations that the Federal Reserve will prove accommodative at a meeting this week. The euro also profited from the weaker dollar, adding 0.2 percent to $1.1348 (EUR=EBS). Markets expect the […]

Recent Comments

- Starlight Herot on Euro Higher on German Data, Sterling Edges Lower

- Frost Dragont on Euro Higher on German Data, Sterling Edges Lower

- Gwinnettt on Euro Higher on German Data, Sterling Edges Lower

- Vanessat on Euro Higher on German Data, Sterling Edges Lower

- Christinet on Euro Higher on German Data, Sterling Edges Lower

Archives

- January 2025

- December 2024

- November 2024

- October 2024

- February 2024

- July 2023

- July 2021

- May 2021

- March 2021

- February 2021

- September 2020

- May 2020

- February 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017