-

Authoradmin

-

Comments0 Comments

-

Category

The pair ended yesterday’s trading session in an attempt to gain bearish momentum due to the overbought signs appearing on the Stochastic and RSI indicators … The downside potential remains intact as long as the pair remains below 1.1380, with targets around 1.1245 as the first target and then the support at 1.1185 as the […]

-

Authoradmin

-

Comments0 Comments

-

Category

-

Tag

The pair fell during Thursday and Friday to settle below the upper limit of the bearish wedge pattern shown on the 4 hour chart. A breach of support at 0.7055 might be enough to end the upside potential, and the pair could then go to test 61.8% Fibonacci at 0.6960. The rise and break of […]

-

Authoradmin

-

Comments0 Comments

-

Category

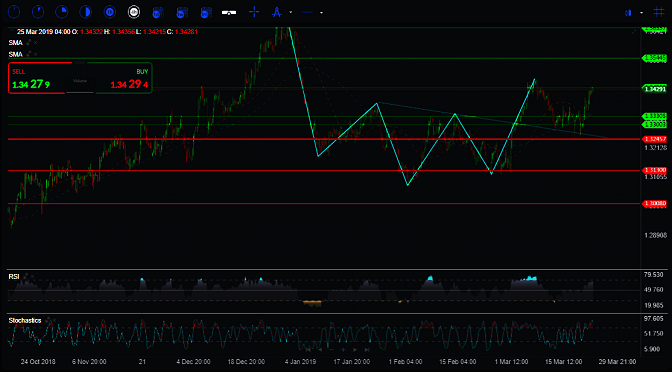

The pair reached its first target of 1.3430 after basing on the neckline of the upside down head and shoulders pattern shown on the chart … The upside remains as long as the pair remains above 1.3245 for the next potential targets around 1.3545 as the second target and then the resistance at 1.3655 as […]

-

Authoradmin

-

Comments0 Comments

-

Category

The pair was positive on Friday with support from 0.9905 (the first target of the downside scenario) in an attempt to test the 0.9975 level and gather some bearish momentum due to the oversold condition on momentum indicators … The downside potential remains intact as long as the pair is trading below 1.0050 and the […]

-

Authoradmin

-

Comments0 Comments

-

Category

The possible bullish scenario remains intact as long as the pair remains above the 1298 support to be the next targets around the resistance 1326 as the first target and then the February summit around 1345 as the second target. A break of the recent 4-hour closing below 1298 might be enough to derail the […]

-

Authoradmin

-

Comments0 Comments

-

Category

The pair fell to achieve its first target of the downside scenario at 110.05 support on Friday … The possibility of the downside remains with the adjustment of the area of failure of the scenario to become 111.00, and could go to the second target at 109.25 support and support 108.50 as a third target. […]

-

Authoradmin

-

Comments0 Comments

-

Category

-

Tag

The pair ended the trading session last Friday on the upside after receiving support from the bullish trend line shown on the 4 hour chart, breaking the resistance 1.3340 (the first objective of the bullish scenario that has been achieved) may push the price to further rise towards the second target level at 1.3480 resistance […]

-

Authoradmin

-

Comments0 Comments

-

Category

The pair fell strongly on Friday breaking the support area 1.1320 – 1.1300 to end the upside scenario which achieved its first target at 1.1405 … The stability of trading below the mentioned area and below the simple moving averages 50 and 100 on the four – hour framework in addition to the negative cross […]

-

Authoradmin

-

Comments0 Comments

-

Category

-

Tag

By Henning Gloystein SINGAPORE (Reuters) – Oil prices slipped on Monday, with concerns of a sharp economic slowdown outweighing supply disruptions from OPEC’s production cutbacks and from U.S. sanctions on Iran and Venezuela. Brent crude oil futures were at $66.73 per barrel at 0752 GMT, down 30 cents, or 0.5 percent, from their last close. […]

-

Authoradmin

-

Comments0 Comments

-

Category

The possible bullish scenario remains valid with the continuation of the bearish wedge pattern shown on the 4 hour chart which targets 0.7215 as the first target and 0.7290 as the second target. A breach of the support zone of 0.7075 – 0.7055 might end the upside potential and the price could then go […]

Recent Comments

- Starlight Herot on Euro Higher on German Data, Sterling Edges Lower

- Frost Dragont on Euro Higher on German Data, Sterling Edges Lower

- Gwinnettt on Euro Higher on German Data, Sterling Edges Lower

- Vanessat on Euro Higher on German Data, Sterling Edges Lower

- Christinet on Euro Higher on German Data, Sterling Edges Lower

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- February 2024

- July 2023

- July 2021

- May 2021

- March 2021

- February 2021

- September 2020

- May 2020

- February 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017