-

Authoradmin

-

Comments0 Comments

-

Category

-

Tag

The pair’s movements are limited within the range between the SMA 100 and the 0.9980 support … it is preferable to remain neutral until the price is way out from the area specified on the chart to confirm its direction … Going back to the highest 1.0060 might be sufficient to confirm the possibility of […]

-

Authoradmin

-

Comments0 Comments

-

Category

-

Tag

Trading in gold has declined over the past two days because of the saturation of the stochastic and RSI indicators on the daily basis … The price is moving favorably during today’s trading after receiving support from 1325-1330 … The possible bullish scenario remains valid as long as the trades remain above the ascending trend […]

-

Authoradmin

-

Comments0 Comments

-

Category

-

Tag

The pair is still trading weakly around its first target at 110.90 … The possible bullish scenario remains intact as long as trades remain above 109.75, and could target the second target at 111.70 and then the 112.50 as the third target … Momentum indicators on each of the four hour time frames, Probability. A […]

-

Authoradmin

-

Comments0 Comments

-

Category

-

Tag

The pair is moving sideways around the uptrend line shown on the four-hour time frame and below its first target at 1.3090 in an attempt to gain momentum … The possible bullish scenario remains intact as long as the pair remains above 1.2960, and the price could reach the second target at 1.3210. A break […]

-

Authoradmin

-

Comments0 Comments

-

Category

-

Tag

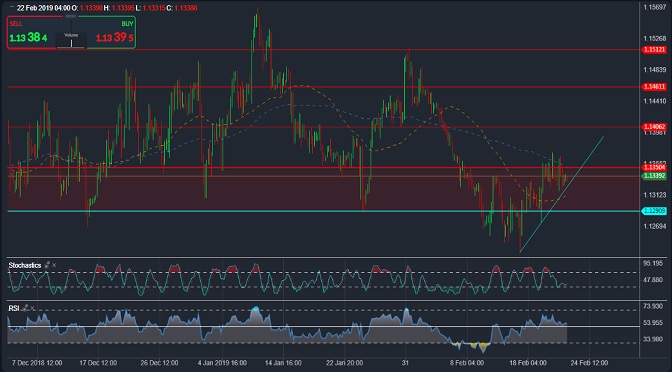

The pair is trading around the 1.1350 level … It is preferable to remain neutral until the breach above the mentioned level and stability above to confirm the possibility of rising towards resistance 1.1405 as the first target and then 1.1460 as the second target at least. A decline and a return to trade below […]

-

Authoradmin

-

Comments0 Comments

-

Category

-

Tag

The pair was unable to breach the 0.7170 level to retreat strongly during morning trading, breaching the bullish formation shown on the chart and approaching 0.7075 support … It is preferable to remain neutral until the price is cleared from the specified area on the chart to confirm its direction … A breach of 0.7075 […]

-

Authoradmin

-

Comments0 Comments

-

Category

-

Tag

The pair fell during yesterday’s trading breaking the support of 1.3200 to return to the upside during the Asian session in an attempt to retest it and gather enough bearish momentum due to the saturation signals indicated by Stochastic and rsi … The best possible scenario: the downside to test support 1.3070 as the first […]

-

Authoradmin

-

Comments0 Comments

-

Category

-

Tag

The pair rises after rebounding from the support of 0.9980 during the Asian session of the day … it is better to stay neutral until the price exit from the area specified on the chart to confirm its direction … Back to the highest 1.0060 may be sufficient to confirm the possibility of resuming the […]

-

Authoradmin

-

Comments0 Comments

-

Category

-

Tag

Gold has gained its bullish momentum due to the saturation of Stochastic and RSI on the daily time frame to close yesterday’s low after achieving its second target for the bullish scenario at 1345 … The bullish scenario remains intact as long as the trades are above the ascending trend line shown on the chart […]

-

Authoradmin

-

Comments0 Comments

-

Category

-

Tag

The pair is still trading weakly around its first target at 110.90 … The possible bullish scenario remains intact as long as trades remain above 109.75, and could target the second target at 111.70 and then the 112.50 as the third target … Momentum indicators on each of the four hour time frames, Probability. A […]

Recent Comments

- Starlight Herot on Euro Higher on German Data, Sterling Edges Lower

- Frost Dragont on Euro Higher on German Data, Sterling Edges Lower

- Gwinnettt on Euro Higher on German Data, Sterling Edges Lower

- Vanessat on Euro Higher on German Data, Sterling Edges Lower

- Christinet on Euro Higher on German Data, Sterling Edges Lower

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- February 2024

- July 2023

- July 2021

- May 2021

- March 2021

- February 2021

- September 2020

- May 2020

- February 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017