07

Mar

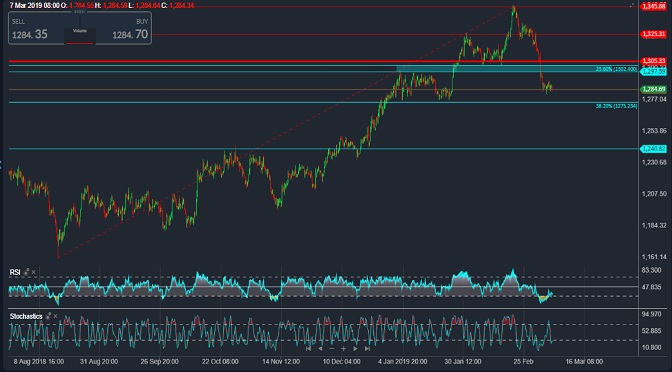

Technical Analysis – XAUUSD _ 07-03-2019

-

Authoradmin

-

Comments0 Comments

-

Category

The pair has moved sideways over the past two days in an attempt to gain bearish momentum due to the oversold resistance shown on the RSI on the daily basis … The 1300-1302 rally seems to be possible but the possible bearish scenario remains intact as long as the trading remains below 1305 (23.6% Fibonacci) to be the first target at the level of 38.2% Fibonacci around 1275, whose penetration may press the gold to go to the next support around 1250 – 1240.

A breach of 1305 and stability above might be enough to end the current correction and it is possible that the price will resume its bullish trend to face 1345 again as the first target, which could push the pair to the next resistance at 1365.

Tags:

Related Posts

Recent Comments

- Starlight Herot on Euro Higher on German Data, Sterling Edges Lower

- Frost Dragont on Euro Higher on German Data, Sterling Edges Lower

- Gwinnettt on Euro Higher on German Data, Sterling Edges Lower

- Vanessat on Euro Higher on German Data, Sterling Edges Lower

- Christinet on Euro Higher on German Data, Sterling Edges Lower

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- February 2024

- July 2023

- July 2021

- May 2021

- March 2021

- February 2021

- September 2020

- May 2020

- February 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017